Gold companies are a crucial sector to watch in 2021 as the global economy continues to navigate through uncertain times. With the price of gold reaching new heights, investors are turning their attention to top gold companies for potential investments. This article will explore projections and investments in the top gold companies to watch in 2021, providing insight into the industry and the potential opportunities for stakeholders.

Some of the top gold companies to watch in 2021 include Newmont Corporation, Barrick Gold, AngloGold Ashanti, and Kinross Gold. These companies are expected to benefit from the projected increase in gold prices due to global economic uncertainty and inflation concerns. Investors are showing interest in these companies for their potential to deliver strong returns in the current market conditions. Additionally, these companies are making strategic investments in expanding their production capacity and optimizing their existing operations to capitalize on the bullish gold market.

Top 10 Gold Companies Making Waves in the Market

1. Newmont Corporation: A leading gold mining company with operations in various countries, including the United States, Australia, and Ghana.

2. Barrick Gold Corporation: One of the largest gold mining companies in the world, with a strong focus on sustainable mining practices and community engagement.

3. AngloGold Ashanti: Known for its gold mining operations in Africa, AngloGold Ashanti is also expanding its presence in other regions, including the Americas and Australia.

4. Gold Fields Limited: This South African gold mining company has been gaining attention for its exploration efforts in new regions and its commitment to responsible mining practices.

5. Kinross Gold Corporation: With operations in the Americas, West Africa, and Russia, Kinross Gold has been making significant investments in expanding its production capacity.

6. Agnico Eagle Mines: A Canadian gold mining company known for its strong financial performance and focus on operational excellence.

7. Kirkland Lake Gold: This mid-tier gold mining company has been generating buzz in the market due to its high-grade, low-cost underground gold mines.

8. Yamana Gold: With operations in Canada, Brazil, Chile, and Argentina, Yamana Gold has been focused on optimizing its existing mines and exploring new opportunities for growth.

9. Polyus: The largest gold producer in Russia, Polyus has been making strategic investments to increase its production and reserves.

10. Harmony Gold Mining Company: A South African gold mining company with a diverse portfolio of mines and a strong commitment to sustainability and social responsibility.

The Rise of Gold Companies: A Look at Industry Leaders

The rise of gold companies has been driven by a variety of factors, including increasing demand for gold as an investment, the decline in production from traditional gold mining sources, and the growth of new technologies for extracting gold from unconventional sources. Some of the industry leaders in the gold sector include Barrick Gold Corporation, Newmont Corporation, AngloGold Ashanti, Kinross Gold Corporation, and Gold Fields Limited. These companies have established themselves as leaders in the industry through their efficient operations, strong financial performance, and strategic investments in new projects and technologies. As the global demand for gold continues to rise, these companies are well-positioned to maintain their leadership in the industry.

Investing in Gold Companies: What You Need to Know

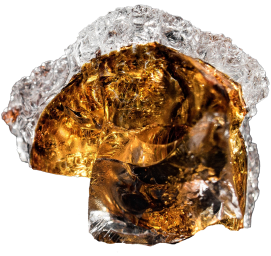

See also: a gold detector

Investing in gold companies can be a valuable addition to a diversified investment portfolio. When considering investing in gold companies, it is important to conduct thorough research and due diligence on the companies themselves, as well as the overall market conditions for gold. This may involve analyzing a company’s financial health, management team, and production capabilities.

Additionally, it is important to consider the various ways to invest in gold companies, including buying individual stocks, investing in gold-focused exchange-traded funds (ETFs), or purchasing shares of gold mutual funds.

Furthermore, it is crucial to stay informed about factors that can impact the price of gold, such as inflation, interest rates, and geopolitical events. Understanding these factors can help make informed decisions about investing in gold companies.

It is also advisable to consult with a financial advisor before making any investment decisions, and to only invest money that you can afford to lose. As with any investment, there are risks involved in investing in gold companies, and it is important to carefully consider these risks before making any investments.

The Future of Gold Companies: Trends and Forecasts

The future of gold companies is subject to various trends and forecasts that will shape the market in the coming years. One of the key trends in the gold industry is the increasing demand for gold as an investment and a store of value, particularly in times of economic uncertainty. Another trend is the shift towards more sustainable and responsible mining practices, driven by environmental and social concerns.

Additionally, the use of technology in gold mining and extraction is expected to increase, as companies seek to improve efficiency and reduce costs. This includes the use of automation, artificial intelligence, and data analytics in mining operations.

In terms of forecasts, many experts believe that the price of gold will continue to be influenced by factors such as geopolitical tensions, inflation, and currency fluctuations. Overall, the future of gold companies is likely to be shaped by a combination of market demand, technological advancements, and regulatory and environmental pressures.

Exploring Opportunities with Junior Gold Companies

Exploring opportunities with junior gold companies can be an exciting prospect for investors looking to enter the precious metals market. Junior gold companies are typically smaller, less established firms that are focused on exploration and development of new gold deposits. These companies often have the potential for significant growth if they are successful in their endeavors.

Investing in junior gold companies can be a high-risk, high-reward proposition. These companies may have limited resources and their success is heavily dependent on their ability to make new discoveries and bring them into production. However, successful investments in junior gold companies can provide significant returns for savvy investors.

Before diving into the world of junior gold companies, it’s important to conduct thorough research and due diligence. This includes evaluating the company’s management team, financials, and most importantly, their mining properties. Understanding the potential risks and rewards of investing in junior gold companies is crucial for making informed investment decisions in this sector.

The Role of Gold Companies in Global Economies

Gold companies play a significant role in global economies by contributing to job creation, infrastructure development, and providing a valuable commodity for investment and trade. Gold mining companies are often major employers in the areas where they operate, providing jobs and economic opportunities to local communities.

Additionally, the activities of gold companies contribute to the development of infrastructure in regions where they operate, including roads, power supply, and water infrastructure. This, in turn, helps to stimulate economic growth and development.

Furthermore, gold is a highly sought-after commodity for investment and trade, and gold companies play a crucial role in meeting this demand by extracting and refining gold for use in jewelry, technology, and as a store of value. The global gold market also has significant implications for currency exchange rates and financial market stability.

In summary, gold companies have a significant impact on global economies through job creation, infrastructure development, and their role in the gold market as a valuable commodity for investment and trade.

Sustainability in Gold Mining: The Responsibility of Companies

Sustainability in gold mining is an important issue as it involves the responsible management of environmental, social, and economic impacts. Companies engaged in gold mining have a responsibility to ensure that their activities are conducted in a sustainable manner, minimizing negative effects on the environment and local communities.

This involves implementing measures to reduce water and energy consumption, minimize waste generation, and restore land to its original state after mining activities have ended. Companies also need to ensure the safety and well-being of workers, as well as the local communities in which they operate.

Furthermore, responsible gold mining companies are expected to adhere to ethical and transparent business practices, including respecting the rights of indigenous peoples and local stakeholders. This may involve engaging with communities to address concerns and provide economic opportunities that benefit them in the long term.

Sustainability in gold mining also extends to supply chain management, ensuring that the gold extracted is not sourced from illegal or unethical practices, such as conflict financing or environmental degradation.

Overall, the responsibility of companies in gold mining is to balance the need for resource extraction with the need to minimize environmental and social impacts, while also contributing to local development and long-term sustainability.

Navigating the Challenges Faced by Gold Companies Today

Navigating the Challenges Faced by Gold Companies Today involves addressing a variety of issues, including fluctuating gold prices, geopolitical uncertainties, regulatory changes, environmental concerns, and rising production costs. Gold companies must also manage risks associated with mining operations, such as safety hazards, resource depletion, and community relations. Additionally, staying competitive in the market and adapting to technological advancements are crucial for long-term success. Overall, gold companies must employ strategic planning, efficient operations, and sound decision-making to overcome these challenges and thrive in a dynamic industry.

The Impact of Technology on the Operations of Gold Companies

The impact of technology on gold companies’ operations has been significant in recent years. Advancements in technology have allowed for improved efficiency in mining operations, including the use of automated machinery and advanced exploration techniques. This has resulted in increased productivity and reduced operational costs for gold companies.

Furthermore, technology has also played a crucial role in improving safety standards in gold mining operations. The introduction of remote monitoring and control systems has enabled companies to better ensure the safety of their workers and prevent accidents.

In addition, technology has also had an impact on the processing and refining of gold. The use of advanced equipment and processing techniques has allowed for higher extraction yields and improved overall quality of the final product.

Overall, the integration of technology into the operations of gold companies has led to increased efficiency, improved safety standards, and greater profitability in the industry. As technology continues to advance, the impact on the operations of gold companies is likely to become even more pronounced in the future.

How Gold Companies Are Adapting to Changing Market Conditions

Gold companies are adapting to changing market conditions by implementing various strategies. One common approach is to diversify their operations and invest in other precious metals, such as silver and platinum, to spread the risk and maximize returns. Additionally, companies are employing advanced technologies to improve their mining processes and reduce production costs. This includes using digital tools for data analysis, automation, and remote monitoring. Some gold companies are also focusing on sustainable practices and ethical sourcing to meet the changing demands of socially responsible investors. Overall, gold companies are actively responding to market shifts by evolving their business models and adopting innovative practices.