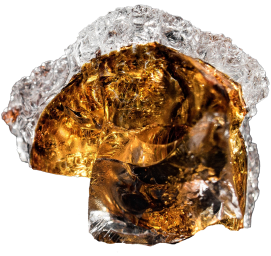

Gold in silver has always been a captivating combination, adding a touch of elegance and luxury to any piece of jewelry or decorative item. The way these two precious metals complement each other is a sight to behold, and discovering the beauty of gold in silver is truly a remarkable experience. From intricate designs to stunning accessories, the combination of gold in silver has a timeless allure that never fails to captivate. Whether it’s the subtle shimmer of silver accentuated by the warmth of gold, or the delicate balance of these two metals intertwined in a single piece, the beauty of gold in silver is a precious combination worth exploring. In this article, we will delve into the enchanting world of gold in silver and uncover the allure of this magnificent pairing.

Discovering the Beauty of Gold in Silver: A Precious Combination is a book that explores the unique beauty and allure of combining gold and silver in jewelry and decorative arts. The book delves into the history and cultural significance of this combination, as well as the technical aspects of working with both metals. It also features stunning photographs showcasing the stunning results of combining these two precious metals. Whether you are a jewelry maker, collector, or simply interested in the history and artistry of gold and silver, this book offers a comprehensive look at the beauty and craftsmanship of this unique pairing.

Exploring the Relationship Between Gold and Silver Prices

The relationship between gold and silver prices is complex and multifaceted. Both gold and silver are considered precious metals and are often seen as safe-haven assets during times of economic uncertainty. As a result, their prices can be influenced by similar factors such as geopolitical tensions, inflation, and interest rates.

However, the two metals also have distinct industrial uses, which can lead to diverging price movements. For example, silver is used in a wide range of industrial applications including electronics, solar panels, and medical devices. This means that silver prices can be more sensitive to changes in industrial demand compared to gold.

Additionally, the supply and demand dynamics for gold and silver can be different, leading to varying price movements. For example, gold is often mined as a byproduct of other metals such as copper and nickel, while silver is often produced as a byproduct of base metals like lead and zinc. This means that changes in base metal production can impact the supply of silver, and consequently its price.

Overall, analyzing the relationship between gold and silver prices requires a comprehensive understanding of both metals’ unique characteristics, as well as the broader economic and market factors that can influence their prices.

The Role of Gold and Silver in Diversifying Investment Portfolios

Gold and silver have historically been considered safe-haven assets and are often used as a hedge against inflation and currency devaluation. They tend to behave differently from stocks and bonds, making them effective in diversifying investment portfolios. The prices of gold and silver are not strongly correlated with the stock market, which can help reduce overall portfolio risk. Additionally, they have maintained their value over time and are seen as a store of wealth. Many investors include gold and silver in their portfolios to help protect against economic uncertainty and market volatility. Overall, these precious metals can play a valuable role in diversifying investment portfolios and reducing overall risk.

Comparison of Gold and Silver as Precious Metals

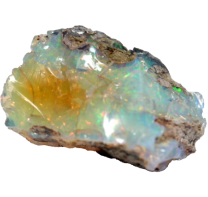

Gold and silver are both considered precious metals, valued for their beauty and scarcity. They have been used for currency, jewelry, and other ornamental purposes for thousands of years. While both metals have similar properties, such as high luster and conductivity, there are some key differences between them.

Gold is generally more valuable than silver, primarily due to its scarcity and the higher cost of mining and refining it. Gold is also more resistant to corrosion, making it a popular choice for jewelry and other long-lasting items. Silver, on the other hand, is more widely used in industrial applications such as electronics and photography.

In terms of investment, gold is often seen as a more stable and secure asset, making it a popular choice for diversifying investment portfolios. Silver, on the other hand, is considered to have higher volatility and is often used for short-term trading and speculation.

Overall, both gold and silver have their own unique properties and characteristics that make them valuable as precious metals. Whether it’s for investment, jewelry, or industrial use, both metals have their own distinct advantages and appeal.

Understanding the Historical Significance of Gold and Silver

See also: gold detector

Gold and silver have been used as forms of currency and valuable assets for thousands of years. They have played crucial roles in the development of economies, trade, and global commerce. The historical significance of gold and silver can be seen in their use as mediums of exchange, stores of value, and indicators of wealth and prosperity. Additionally, their rarity and enduring allure have contributed to their status as symbols of power, beauty, and luxury across various cultures and civilizations throughout history. Their enduring appeal and historical significance continue to shape their roles in today’s financial and investment markets.

The Potential for Growth in Gold and Silver Markets

The potential for growth in the gold and silver markets can be attributed to several factors. One of the main drivers for the continued growth of these markets is the increasing demand for precious metals as safe-haven assets. Economic and geopolitical uncertainties often lead investors to seek out the stability and security offered by gold and silver.

Furthermore, the growth of emerging economies and the expanding middle class in countries like China and India have contributed to rising demand for physical gold and silver as both investment and jewelry. Additionally, the increasing use of silver in industrial applications, such as electronics and solar panels, has also bolstered demand for the metal.

In terms of supply, gold and silver production has been relatively stagnant, with some reports suggesting that peak gold and peak silver may have already been reached. This limited supply, coupled with growing demand, creates a favorable environment for potential growth in the gold and silver markets.

Overall, the combination of economic, geopolitical, and industrial factors positions gold and silver as attractive investment options with strong potential for growth in the coming years.

Factors Influencing the Values of Gold and Silver

The values of gold and silver are influenced by a variety of factors including supply and demand, geopolitical events, inflation, interest rates, currency fluctuations, and market sentiment. Additionally, the value of gold and silver can also be impacted by changes in industrial and jewelry demand, as well as investment trends. Overall, these factors can contribute to the fluctuation of gold and silver prices in the global market.

Investing in Gold and Silver: A Beginner’s Guide

Investing in Gold and Silver: A Beginner’s Guide is a comprehensive resource for those interested in adding precious metals to their investment portfolio. It covers the basics of understanding the gold and silver market, the different ways to invest in these metals, and the potential risks and rewards associated with precious metal investments. The book also provides guidance on how to purchase and store physical gold and silver, as well as considerations for investing in gold and silver stocks, mutual funds, and exchange-traded funds. Whether you’re new to investing or an experienced investor looking to diversify your portfolio, this book offers valuable information to help you make informed decisions about investing in gold and silver.

The Industrial Uses for Gold and Silver

Gold and silver are widely used in various industrial applications due to their unique properties. Gold is a good conductor of electricity and is therefore used in electronic devices such as cell phones, computers, and televisions. It is also used in the aerospace industry for its resistance to corrosion and high conductivity. Silver is used in the production of photovoltaic cells for solar panels, as well as in the manufacturing of medical equipment, mirrors, and electrical contacts. Both metals are also used in the production of high-quality jewelry and decorative items. Additionally, gold and silver are used in the chemical industry for their catalytic properties and in the automotive industry for their durability and aesthetic appeal.

The Environmental Impact of Mining Gold and Silver

Mining for gold and silver has significant environmental impacts due to the use of chemicals such as cyanide to extract the precious metals from the ore. This can result in contamination of soil, water, and air, which can harm wildlife and human health. Additionally, the process of removing and disposing of waste rock and tailings can lead to habitat destruction and ecosystem disruption. Deforestation and displacement of local communities are also common consequences of mining for gold and silver. Large amounts of water are required for mining operations, leading to potential depletion of local water sources and impacting the surrounding ecosystems. Overall, the environmental impact of mining for gold and silver can be severe and long-lasting.

Future Outlook for Gold and Silver in the Global Economy

The future outlook for gold and silver in the global economy appears to be positive due to several factors. Economic uncertainty and geopolitical tensions continue to drive demand for precious metals as safe-haven investments. Additionally, low interest rates and expansive monetary policies by central banks provide a favorable environment for precious metals as they have traditionally served as a hedge against inflation.

Furthermore, the growing adoption of renewable energy technologies and the increasing demand for silver in industrial applications, particularly in the production of electronics and solar panels, are expected to drive up the demand for silver.

However, the future outlook for gold and silver also faces potential challenges such as fluctuations in currency values, changes in global economic conditions, and potential developments in mining technology that could impact the supply-and-demand dynamics of these metals.

Overall, while there may be short-term volatility, the long-term future outlook for gold and silver in the global economy continues to remain strong, with the potential for continued growth in demand and value.

In conclusion, the combination of gold and silver creates a truly precious and exquisite blend of beauty. Whether it’s in jewelry, home décor, or any other form, the shimmering allure of gold in silver adds an undeniable touch of elegance and sophistication. This precious combination will continue to captivate and inspire for generations to come.

See also

https://www.maisondeladetection.com/

https://www.inventumdetector.fr/

https://www.detecteurs.fr/